Last year there were some pretty unprecedented leaks, including Equifax, the credit agency. The Equifax leak may be one of the worst possible ones, given its broad scope and the information they had available.

So you can be forgiven for being somewhat reluctant when I suggest you should be checking your credit score… using Equifax.

But the way I look at it, they already have all your info (unless you have never used any credit, never had a cell phone, etc). And, you want to know if someone is opening accounts in your name etc. So, its better you know this, since Equifax already does (and anyone who has access to it).

Last night we had a credit card hacked. Now, I’ve been using Chip’n’Pin for >15 years, so it always shocks me when I enter a country (I’m looking @ you US) where its not ubiquitous. But for sure skimmers exist. I got caught once (a Norwegian flight, credit card to buy a sandwich on flight, landed to it cancelled and a call from Visa).

So lets check the report (its only updated monthly sadly) to see if someone is opening something in our name.

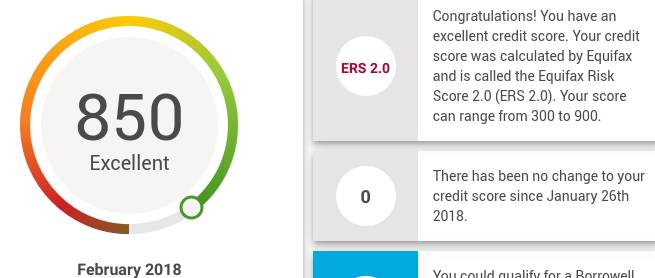

First, you get a little round chart, like at the right. But then you get a more full report, indicating when your credit file was opened (30 years ago for me!). In it, you will see all the revolving (credit cards, line of credit), installment (car payments), and open (e.g. your cell phone) lines. Look for ones you didn’t authorise.

Its free to get your credit report (google it, pick one, I used ‘borrowell’). Do this, monitor it periodically. That way if for some reason you get pwned in a way that Visa doesn’t catch, you will.

It goes without saying, managing risk is not about ‘zero risk’, but about ‘risk/reward’. Here, the ‘cost’ side of that equation is small (free credit report, signing up takes 5 minutes). And the benefit is large. Risk management is not about ‘zero-risk’ (cuz you’d have no life to live). But easy stuff like this? get on it.

It also goes without saying that a way to manage risk is to make sure you don’t use the same password for any two online sites. Use a password manager (e.g. built into chrome or another). And don’t use ‘swipe’ on your credit card, use ‘tap’ or ‘chip’. If the establishment doesn’t support tap/nfc/contactless or chip+pin, ask them to add it. It shocks me to see places with the equipment there but it is disabled. Ultimately they share this risk since Visa will charge it back to them. But by then all parties have a cost.

Leave a Reply