I’m a big fan of blockchain technology and crypto-currency as a concept. The general strategy that BitCoin employed was a genius ecosystem: Allow people to gain wealth, but force them to show evidence of work, and then use that work to drive the transactions and blockchain math that makes the network go. Great.

Except… they used electricity as the work evidence. You have to take power and destroy it to mine BitCoins. And, because they were worried about Moore’s law and fancy silicon letting someone run away with it all, the amount of energy needed goes up. A lot. And this is unsustainable. The BitCoin network is purposely inefficient, using as much power as it can, by design. And the more transactions people do, the more power it uses, until eventually it gets choked by either transaction fees (you need to pay for that power, currently estimated as 234kWh/transaction. Put another way, every transaction costs (~$0.10 – $0.20) * 234 == $25-$50 just in power. Or, I could ‘fill’ my wife’s car 4 times with power and drive 1600km for every transaction. You want me to buy you a coffee with BitCoin?

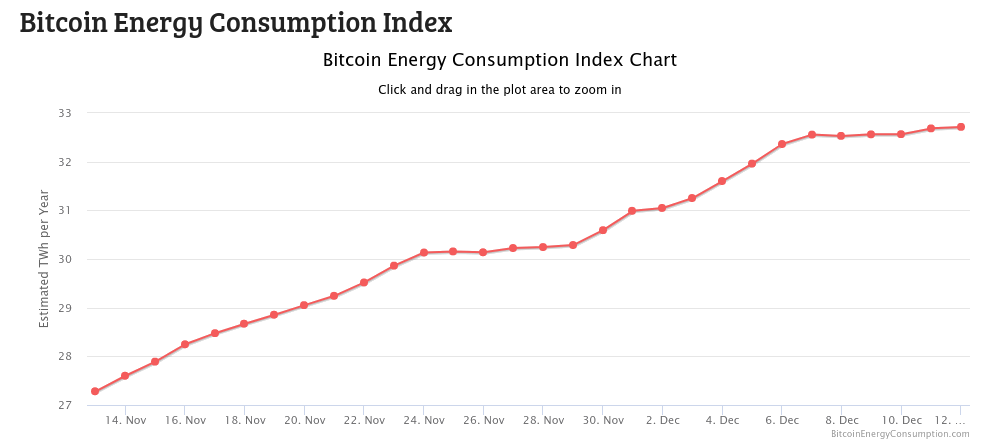

If we look at the estimates of BitCoins current power production (recently referred to in units of Denmarks!), and realise we have just started futures trading on BitCoin (which must drive transactions upwards), we should be worried. But what about the damage caused already? It appears from the graph below that we are already using about as much power to drive BitCoin than all the solar production online in the US [4.5GWh/month == 54TWh/yr]. (and worse, much of the BitCoin is mined using dirty coal power in China).

Now, back to the technology. Unless there is some obstruction, technology tends to drive towards efficiency, not away. Blockchain is good, crypto-currency is good. But BitCoin is hampered by an anti-design goal, that of being inefficient. A crypto-currency that drives blockchain using a different evidence of work (solving the human genome? curing cancer? driving towards least power used per hash?) is likely to come on the scene, and we’ll look back at BitCoin as the pioneer of the space, the idea, but not the technology that won (yes I’m aware of BitCoin cash, Ether, etc…). It may be like the CFL (a more efficient light, with a brief lifespan before LED took it over). But I don’t plan on ‘investing’ in BitCoin at this time. In 1 year you can come back and say “I told you so” based on this statement, cuz i’m sure with all the froth the market will go up for a while, but I don’t believe it will continue.

tl;dr: I’m a blockchain bull and a BitCoin bear.

Leave a Reply